Quasi-Equity

Scale your impact

What is Quasi-Equity?

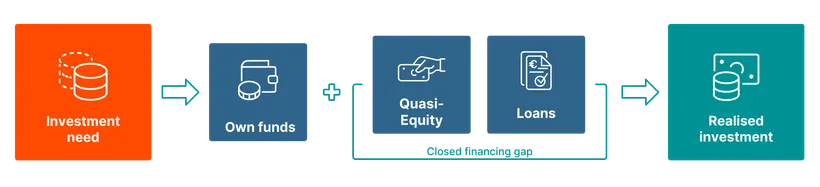

Quasi-Equity is a subordinated loan for your social or green business, which strengthens your capital base and covers up to 30 % of your planned investments. The financing volume ranges from EUR 50,000–500,000.

It also improves your financial and risk profile, enabling you to obtain further co-financing with a bank loan. As a result, you can bring your plans to life and your social or green business can continue growing.

Quasi-Equity doesn’t require any personal guarantees or collateral from you and has no effect on your company’s ownership structure. You pay a fixed interest rate over an agreed term of up to ten years. And best of all, you only begin to make principal repayments after four years.

Besides our financial service, we are also here to support you. In regular meetings, we advise you on your individual concerns. Moreover, we give you access to our broad network of people from a wide range of industries.

Who is Quasi-Equity for?

It is just right for you if...

- your business has already been running for at least two years

- you have a proven, innovative business model

- you have already reached breakeven or are about to do so

- you have demonstrated a positive social/green impact

Benefits of Quasi-Equity

Repayment holidays up to 4 years

No change in ownership structure

No personal guarantee

Testimonial

Unverschwendet

Cornelia and Andreas Diesenreiter have made it their mission to rescue food that would otherwise go to waste. In Austria, 760 million kg are discarded every year. Instead of letting it go to waste, Unverschwendet transforms surplus produce into delicious products like jams and juices – and it is working: they save around 450 tonnes of food each year.

How to reach us

If you believe Quasi-Equity is perfect for you, you’re probably right. Simply get in touch with us and we will happy to assist:

Support & Partners

This financing benefits from a guarantee funded by the European Union under the Programme for Employment and Social Innovation (EaSI).